Making Sense of Property Statistics

To mark Chinese New Year this week, let us start by offering up an old Chinese blessing: ‘May you live in interesting times’. Of course, as we now know, this is equal part blessing and equal part curse – perhaps it depends upon your perspective. We were reminded of this in the Sunday papers earlier this week when the Sunday Independent ran a feature, detailing all the ways by which the Irish housing market could be facing a hit in 2019. It was a long list.

To start with, mortgage approvals for first-time buyers were down in December. Coupled with falling levels of new housing output in Dublin, it is understandable that the outlook for the housing market in 2019 appears uncertain. However, further reading into this showed that while lending levels for first-time buyers and the buy-to-let sectors were down 2.4% and 16% respectively, Irish banks actually approved 2,908 new mortgages in December 2018 with a total value of €656m. This is an increase of 6% on similar figures for December 2017. It is unclear what, if any, conclusion might be drawn from these figures.

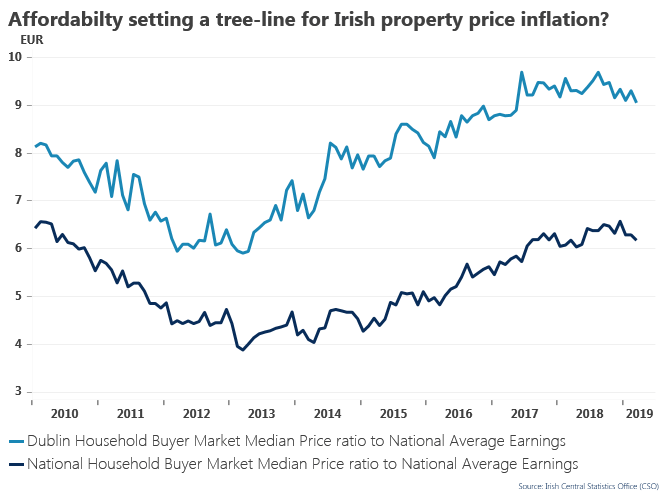

One interesting statistic included was that average Dublin house prices rose by almost 97% from their 2012 low to their 2018 high, while house prices nationwide rose by 78% in a similar period. It will not surprise many to read that house prices in Dublin and across the rest of the country fell slightly towards the latter part of 2018, 0.7% and 0.1% respectively.

House building activity is obviously a key focus of ours and this can be difficult to track, given the contentious source of data (ESB connections versus new units actually completed). It is not particularly helpful to refer back to the peak activity levels of 2006, when 93,000+ homes were being delivered into the marketplace annually, however, it does provide context when we talk about the low of 4,500 by 2013, which is now expected to rise to an estimated 21,700 for 2019. By any reckoning, we are still well behind meeting the demand established by Goodbody Stockbrokers. Their chief economist Dermot O’Leary estimates underlying demand to be about 35,000 units each year.

You might recall that over recent weeks we have written about the concentration of existing home building activity at the upper end of the market rather than in the €275,000 to €375,000 affordable price point that most first-time buyers can reasonably afford. This is undoubtedly a problem within the housing market, but is it, in equal measure, an opportunity for the industry?

With the price of all homes, second-hand and new homes, at the upper end of the market likely to slow down and possibly decrease in 2019, is now the time to refocus our efforts on the mid-level market (which is actually the lower end of the market in Dublin)? If this is indicative of a trend for the industry, then it becomes increasingly important for the current Housing Minister to signal his support to retain the existing

help-to-buy scheme, which is due to expire at the end of the year. It certainly appears likely that this scheme will be extended (or replaced with a similar incentive) and if this is the case, the buying public needs to be informed as early as possible to avoid any ‘wait and see’ delays.

Ian Lawlor

086 3625482

Director / Business Development

Lotus Investment Group